Bet365 Review

Bet365 is one of the most well-known and widely used online betting platforms in the world, offering a vast array of betting options and features to its customers. In this comprehensive Bet365 review, we will take an in-depth look at everything you need to know about this platform, including how to join Bet365 in India, how to make a deposit, and the various betting options available.

One of the key features of Bet365 is its extensive range of betting options, which includes sports betting, casino games, poker, and more. Whether you are a beginner or an experienced punter, Bet365 has something to offer you. Whether you’re interested in football, cricket, horse racing, or any other sport, Bet365 offers a wide range of markets and competitive odds to choose from.

Another important aspect of Bet365 is its customer support. The platform offers excellent customer service, with a dedicated team of professionals available 24/7 to assist with any queries or issues you may have. Additionally, Bet365 has a user-friendly interface that makes it easy to navigate and find the information you need.

In terms of history, Bet365 has been in the online betting industry for over 20 years. It was founded in 2000 by Denise Coates, who is still the current CEO. Over the years, it has grown to become one of the largest and most reputable online betting platforms in the world.

In conclusion, Bet365 is a great platform for all types of bettors, offering a wide range of betting options, features, and excellent customer support. Whether you’re new to online betting or a seasoned pro, Bet365 is a platform that is definitely worth checking out.

Bet365: About Company

Bet365 is a leading online gambling company that was founded in 2000 and is headquartered in the United Kingdom. The company is fully licensed and regulated by the UK Gambling Commission and offers a wide range of gambling products, including sports betting, casino games, poker, and bingo. With over 35 million customers in more than 200 countries, Bet365 has established itself as one of the most popular and trusted online betting platforms in the world.

One of the key strengths of Bet365 is its commitment to responsible gambling. The company offers a variety of tools and features to help customers stay in control of their spending, such as deposit limits and reality checks. Additionally, Bet365 is a member of the Responsible Gambling Trust, an independent UK charity that provides support and assistance to individuals affected by problem gambling.

Bet365 also boasts a highly reputable customer service, with an experienced and dedicated team of professionals available 24/7 to assist with any queries or issues. This is evident in the numerous positive Bet365 reviews from customers all over the world that can be easily found online.

In conclusion, Bet365 is a well-established and reputable online gambling company that offers a wide range of products and features, with a strong emphasis on responsible gambling and excellent customer service. With millions of satisfied customers worldwide, Bet365 is a platform that is definitely worth considering for your online betting needs.

Bet365 overview: services, sports betting, casino, poker and bingo

Bet365 is one of the world’s leading online gambling companies, offering a wide range of betting options to customers in over 200 countries. The company was founded in 2000 by Denise Coates and is headquartered in Stoke-on-Trent, England.

One of the most popular features of Bet365 is its sports betting platform. The company offers a wide range of sports markets, including football, cricket, tennis, and horse racing. Customers can also bet on less popular sports such as darts, snooker, and e-sports. Bet365 also offers live streaming of many sports events, allowing customers to watch the action as it unfolds and place in-play bets.

In addition to sports betting, Bet365 also offers a casino, poker, and bingo. The casino features a wide selection of slots, table games, and live dealer games, while the poker room offers a variety of tournaments and cash games. The bingo room features a variety of bingo games, including 75-ball and 90-ball.

Bet365 also provides a number of features to help customers manage their gambling, including deposit limits and self-exclusion. The company also offers a cash-out feature, which allows customers to settle their bets before an event has finished. This can be useful if they think the result is no longer in doubt and they want to lock in a profit. Overall, Bet365 offers a comprehensive and user-friendly gambling experience for customers.

Bet365’s history

Bet365 is an online gambling company that was founded in 2000 by Denise Coates. The company is headquartered in Stoke-on-Trent, England, and serves customers in over 200 countries. Bet365 offers a variety of services, including sports betting, casino, poker and bingo.

The company has grown significantly since its founding and is now one of the world’s largest online gambling companies. In 2016, Bet365 generated revenues of £12 billion ($15.73 billion), making it the largest privately-owned online gambling company in the world. This is largely due to its diverse range of services and its reputation for providing a high-quality user experience.

Bet365 has also invested heavily in marketing and sponsorship, particularly in sports. The company is a major sponsor of Stoke City FC, an English football club, as well as a number of other sports teams and events, including horse racing, darts, and snooker. This has helped to raise the company’s profile and attract new customers.

In addition, Bet365 has also made strategic acquisitions over the years, such as the acquisition of the streaming platform, Stream2watch, which allow them to expand their offerings and continue to provide a great experience for its customers.

Overall, Bet365’s history is a story of steady growth, strategic investments, and a commitment to providing a high-quality user experience. This has enabled the company to become one of the world’s largest online gambling companies and a trusted name in the industry.

Is Bet365 Legal for Indians?

Yes, Bet365 is legal for Indians to use. As a licensed and regulated online betting platform, Bet365 is able to offer its services to customers in India. However, it is important to note that the legal status of online gambling in India is somewhat ambiguous. While there are no laws that specifically prohibit online gambling, the activity is not currently regulated by the Indian government.

This means that Indians may participate in online gambling, but there is no official oversight or regulation in place to ensure fair play and protect consumers. Despite this, Bet365 is a highly reputable and trustworthy platform that is licensed by the UK Gambling Commission and is also a member of the Responsible Gambling Trust. These factors, along with Bet365’s strong focus on responsible gambling, make it a safe and reliable option for Indian customers.

It’s important to note that as per laws, online gambling is not legal in some states in India, and it’s always advisable to check the state laws of where you are located before signing up and participating in online gambling.

In conclusion, while online gambling is not currently regulated in India, Bet365 is a legal and licensed platform that Indian customers can use without any issue. It is also considered safe and trustworthy platform due to its regulatory oversight and commitment to responsible gambling.

Bet365 Features and Tools

Bet365 is a leading online gambling company that offers a wide range of services, including sports betting, casino, poker, and bingo. One of the key features of the platform is the ability to live stream a variety of sports events, including football, cricket, tennis, and horse racing. This allows customers to watch the event and place bets at the same time.

Another popular feature is in-play betting, which allows customers to place bets on sports events while they are taking place. This allows for more dynamic and exciting betting options. Additionally, Bet365 offers the cash out feature, which allows customers to settle their bet before the event has finished, which can be useful in securing profits or minimizing losses.

Bet Builder is another unique feature that allows customers to create custom bets on football matches by selecting from a wide range of markets, such as match winner, first goal scorer, and both teams to score.

Bet365 also has a number of responsible gambling options, such as deposit limits and self-exclusion, to help customers manage their gambling habits.

How to join Bet365

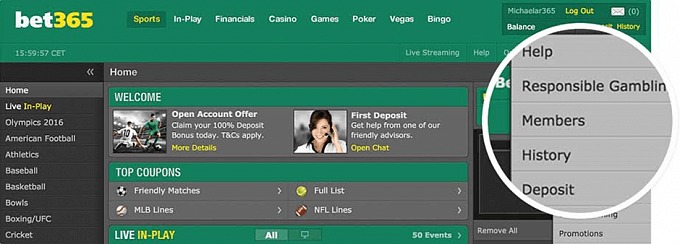

Bet365 is one of the world’s leading online gambling companies, offering a wide range of services including sports betting, casino, poker, and bingo. To join Bet365 in India, you can visit their website and click on the “Join Now” button. This will take you through the registration process, where you will be asked to provide some personal information such as your name, birthday, and email address. Once you have completed the registration process, you can log in to your account and start betting.

To deposit money into your Bet365 account in India, there are a number of options available. The most popular method is to use an e-wallet such as Neteller or Skrill. Other options include using a credit or debit card, bank transfer, or Paysafecard. Bet365 also accepts deposits in rupees, so you don’t have to worry about currency conversion fees. To deposit money, simply log in to your account and click on the “Deposit” button. Then select your preferred payment method and enter the amount you want to deposit. Your money will be credited to your account instantly.

Is it Safe to Use Bet365?

When it comes to online betting, safety and security should be a top concern. Bet365 is a reputable and legally licensed platform that is committed to protecting its customers’ personal and financial information. The platform uses the latest 128-bit SSL encryption technology to safeguard all data transmitted to and from the site, ensuring that all personal and financial information is kept safe from unauthorized access.

In addition to the advanced encryption technology, Bet365 also undergoes regular independent audits from eCOGRA (e-Commerce Online Gaming Regulation and Assurance), a leading organization that specializes in testing and certifying online gaming products. These audits are conducted to ensure that Bet365 is operating in a fair and responsible manner, and that all games offered on the platform are random and unbiased.

Bet365 is also a member of the Responsible Gambling Trust, a UK-based charity that helps people affected by problem gambling. This further demonstrates Bet365’s commitment to responsible gambling and customer protection.

In conclusion, Bet365 is a safe and secure platform for online betting. The platform uses advanced encryption technology to protect personal and financial information, undergoes regular independent audits to ensure fair and responsible operation, and is a member of the Responsible Gambling Trust. Customers can be confident that their data is secure and that their experience on the platform will be safe and fair.

Bet365 Customer Service

Bet365 is one of the world’s leading online gambling companies, and as such, it places a strong emphasis on customer support. The company offers a number of ways for customers to get in touch with its support team, including live chat, phone, and email. Customers can also access an extensive FAQ section on the Bet365 website.

The live chat feature is a popular choice among customers as it allows for instant communication with a support agent. Phone support is available 24 hours a day, 7 days a week, and the support team can assist customers in a variety of languages. Email support is also available, and response times are generally within a few hours.

Bet365 also has a dedicated customer support team for responsible gambling, which can assist customers with setting deposit limits, self-exclusion, and other tools to manage their gambling.

Overall, Bet365’s customer support is highly regarded in the industry and is known for its prompt and efficient service. Customers can expect quick response times and helpful support agents who are able to assist with a wide range of queries and issues.

What You Need to Know About Bet365

Bet365 is a reputable and legally licensed online betting company that serves customers in India and around the world. The platform offers a wide range of betting services, including sports betting, casino games, poker, and bingo.

One of the key things you need to know about Bet365 is the platform’s commitment to security and customer protection. To safeguard all personal and financial information, Bet365 uses the latest 128-bit SSL encryption technology, the most advanced type of security available. Additionally, the platform undergoes regular independent audits from eCOGRA (e-Commerce Online Gaming Regulation and Assurance), a leading organization that specializes in testing and certifying online gaming products.

Another important aspect of Bet365 is its focus on responsible gambling. The company is a member of the Responsible Gambling Trust, a UK-based charity that helps people affected by problem gambling. Bet365 also provides several tools and resources to help customers stay in control of their spending and avoid gambling problems.

In summary, Bet365 is a legal, regulated, and safe platform for online betting. It offers a wide range of betting services, uses advanced encryption technology to protect personal and financial information, undergoes regular independent audits, and is committed to responsible gambling. Knowing this key information can help you make an informed decision on whether to use Bet365 and how to do it safely.

How to start betting

You can start by exploring the different sections of the website, such as sports betting, casino games, poker, and bingo. You can also view the live betting options and upcoming events.

To deposit funds into your account, Bet365 offers a variety of options including credit and debit cards, e-wallets, and bank transfers. It’s important to note that some deposit methods may not be available in certain countries. Be sure to check the available options in your region.

Once you have deposited funds, you can start placing bets on your chosen markets. Bet365 offers a user-friendly interface, making it easy to navigate and place bets. They also have a “Help” section with a variety of resources, including a comprehensive FAQ section, to assist you with any questions or issues that you may have.

Additionally, Bet365 offers a variety of promotions and bonuses for its customers, including welcome bonuses and special promotions for specific events. Be sure to check out the “Offers” section of the website to take advantage of these promotions.

Overall, Bet365 is a user-friendly platform that makes it easy for new customers to get started with online betting. With a wide range of markets, easy deposit options, and a focus on responsible gambling, Bet365 is a great choice for anyone looking to start betting online.

Odds

Bet365 is one of the most popular and well-known online sports betting platforms in the world. The company offers a wide range of sports and markets for customers to bet on, including popular sports such as football, basketball, tennis, and horse racing.

In terms of odds, Bet365 is known for offering competitive prices and a wide range of markets. They also offer in-play betting, which allows customers to place bets on events while they are taking place. They also have a cash out feature that allows customers to settle their bets before the event has finished.

When compared to other popular online sports betting platforms, Bet365 is often seen as a leader in the industry. They have a large customer base and are known for their user-friendly interface, wide range of markets, and competitive odds. Other popular platforms such as 1xbet, Betway, and 10CRIC also have a good reputation in the industry. However, Bet365 is considered to be one of the top players in the sports betting market, and is often considered to be the benchmark for other platforms to measure themselves against.

It’s worth noting that Bet365 is also a platform that offers casino, poker and bingo to its customer, which makes it a one stop shop for most of the customers.

What you can bet on Bet365

Bet365 also provides in-play betting, allowing you to place bets on events that are currently happening. This feature is particularly popular for live sports events, such as football matches, where the odds can change rapidly.

Another feature that Bet365 offers is streaming of live events. This allows you to watch and bet on live sports events, such as football matches, directly on the platform.

Bet365 also provides a mobile app, which allows you to place bets and access the platform’s features on-the-go. The mobile app is available for both iOS and Android devices.

One of the best features of Bet365 is the flexibility it offers to users. You can bet on a variety of markets, from popular sports to niche events, and enjoy a seamless experience across different platforms, including desktop, mobile, and live streaming.

Bet365 sportsbook history

Bet365 has a rich history in the online sports betting industry, with over two decades of experience in providing top-notch betting services to customers around the world. The company was founded by Denise Coates in 2000 and has quickly grown to become one of the largest and most successful online gambling companies in the world.

One of the key factors that has contributed to Bet365’s success is its focus on customer satisfaction. The platform offers a wide range of betting markets, including sports, casino, poker, and bingo, ensuring that there is something for everyone. Additionally, the company places a strong emphasis on responsible gaming, providing customers with tools and resources to help them avoid gambling problems.

In addition to its focus on customer satisfaction, Bet365 has also been successful due to its ability to adapt and evolve with the times. The company was one of the first to embrace live streaming, allowing customers to watch live sports events while placing bets. The company also offers a mobile betting app, making it easy for customers to place bets on-the-go.

In 2016, Bet365 generated revenues of £12 billion ($15.73 billion), making it the largest privately-owned online gambling company in the world. The company is also a major sponsor of sports teams and events, including Stoke City FC, horse racing, darts, and snooker. With its strong history, commitment to customer satisfaction, and ability to adapt to changing times, Bet365 is a trusted and respected name in the online sports betting industry.

Features of Bet365

Bet365 is a well-established online betting platform that offers a wide range of features for its customers. One of the most popular features is live streaming, which allows you to watch a wide range of sports events, including football, cricket, tennis, and horse racing, as well as other sports such as darts, snooker, and e-sports.

Another popular feature on Bet365 is in-play betting, which allows you to place bets on sports events while they are taking place. This feature allows you to take advantage of the changing odds and increase your chances of winning.

Bet365 also offers a cash out feature, which allows you to settle your bet before the event has finished. This can be useful if you think the result is no longer in doubt and you want to lock in a profit.

Another innovative feature that Bet365 offers is the Bet Builder, which allows you to create your own custom bet on football matches. You can select from a wide range of markets, including match winner, first goal scorer, and both teams to score.

Bet365 also places a strong emphasis on responsible gambling and provides several tools to assist customers in avoiding gambling problems. These include deposit limits and self-exclusion, which allow customers to set their own limits on their betting activities and take a break from gambling if needed.

Overall, Bet365 is a platform that offers a wide range of features, markets and tools to ensure the best and responsible betting experience for the customers.

How to join Bet365 in India

Additionally, Bet365 also offers the option to register for an account using your mobile phone. To do this, simply download the Bet365 app from the App Store or Google Play Store, and follow the prompts to register for an account. Once you have completed the registration process, you will be able to log in to your account and start betting using your mobile device.

It is important to note that Bet365 is fully regulated and operates legally in India, providing a safe and secure platform for customers to place bets. Additionally, Bet365 offers a variety of deposit and withdrawal options, including local e-wallets and bank transfer, to make the process of funding your account as seamless as possible.

Furthermore, Bet365 offers a wide range of sports betting markets and casino games, as well as providing a number of features such as live streaming, in-play betting, cash out, and Bet Builder. The platform also places a strong emphasis on responsible gaming and provides several tools to assist customers in avoiding gambling problems.

In summary, joining Bet365 in India is a simple and straightforward process that can be done through the website or mobile app. Once you have completed the registration process, you will have access to a wide range of betting markets, features, and responsible gambling tools.

Bet365 mobile app and its usability

Bet365 offers a mobile app for both iOS and Android devices, which provides users with the ability to access the full range of Bet365’s services on the go. The app is designed to be user-friendly and easy to navigate, making it easy for users to find the markets and events they are interested in.

The app includes all of the features available on the desktop site, including live streaming, in-play betting, cash out and Bet Builder. Users can also use the app to deposit and withdraw money, check their account balance and view their betting history.

The mobile app also includes a range of customization options, such as the ability to set notifications for specific events or markets. This allows users to stay up-to-date with the latest odds and results without having to constantly check the app.

Overall, the Bet365 mobile app is highly rated among users for its functionality and usability. Many users find the app to be a convenient and efficient way to access Bet365’s services, and appreciate the added flexibility and convenience it provides.

Promotions and bonuses Bet365

Bet365 offers a variety of promotions and bonuses for both new and existing customers. For new customers, Bet365 often offers welcome bonuses, such as a matched deposit bonus or free bets. These promotions can vary depending on the country you are located in.

Existing customers can also take advantage of a number of promotions, such as enhanced odds on certain events, cashback offers, and loyalty programs. These promotions can change frequently, so it is important to check the website regularly for updates.

Bet365 also has a VIP program for high-volume and high-value customers, which offers exclusive promotions, bonuses and special treatment.

It’s worth noting that all promotions and bonuses come with terms and conditions, so it’s important to read and understand them before participating. Some promotions may have restrictions on the types of bets that can be made and the minimum odds that must be met in order to qualify for the bonus.

How to deposit on Bet365 in India

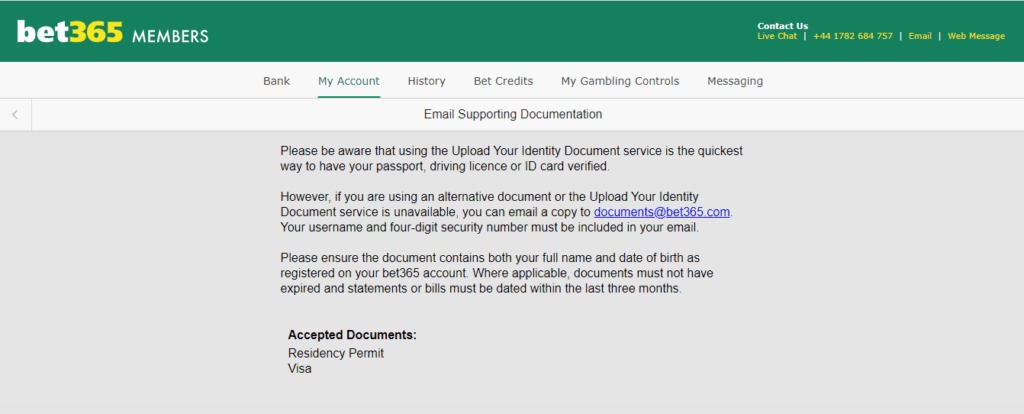

It is important to note that before making a deposit, you will need to verify your identity and address with Bet365. This can be done by submitting a government-issued ID, such as a passport or driver’s license, and a utility bill or bank statement. This is a standard process for all online betting sites and is in place to prevent fraud and money laundering.

Another popular method of depositing funds into your Bet365 account in India is through the use of UPI (Unified Payment Interface). This is a secure and convenient way of transferring funds directly from your bank account to your Bet365 account.

It is also important to note that Bet365 has a minimum deposit amount, which may vary depending on the payment method you choose. Be sure to check the terms and conditions before making a deposit to ensure that you meet the minimum requirements.

Overall, depositing money into your Bet365 account in India is a simple and straightforward process. With a variety of payment methods available, you can choose the one that best suits your needs.

Games available at Bet365

Bet365 is a leading online gambling company that offers a variety of services, including sports betting, casino, poker, and bingo. The casino section of the platform is particularly popular among users, providing a wide variety of games to play.

One of the main attractions of Bet365’s casino is the vast selection of slot games available. The platform offers a variety of themes and styles, with popular titles including Book of Ra, Starburst, and Gonzo’s Quest. The casino also features a number of progressive jackpot slots, providing players with the opportunity to win big.

In addition to slots, Bet365’s casino also offers a wide range of table games. Players can enjoy classic games such as blackjack, roulette, baccarat, and craps. The platform also offers a variety of video poker games and other specialty games.

Bet365 also offers live dealer casino games, which allow players to experience the thrill of playing in a real casino from the comfort of their own home. The live dealer games on Bet365 include blackjack, roulette, baccarat, and poker. They are provided by top gaming providers such as Evolution and Playtech, ensuring high-quality graphics, and seamless gameplay.

Overall, Bet365’s casino offers a wide range of games to suit all types of players, whether they prefer slots, table games, or live dealer games. Additionally, the platform is known for its user-friendly interface, making it easy to navigate and find the desired game.

Poker room Bet365

Bet365 is one of the world’s leading online gambling companies, and its poker room is a popular destination for players of all skill levels. The poker room offers a wide range of games, including Texas Hold’em, Omaha, and Seven Card Stud.

One of the key features of the Bet365 poker room is its tournament schedule. The platform offers a wide variety of tournaments, with buy-ins to suit all budgets. These tournaments include large guaranteed prize pools, as well as satellite tournaments that give players the chance to qualify for major live events around the world.

In addition to its tournament offerings, Bet365 also has a strong cash game offering. Players can find games at a variety of stakes and formats, including no limit, pot limit, and fixed limit.

Bet365’s poker room also offers a number of features to help players improve their game, such as hand history replayer and a built-in odds calculator. The platform also offers a range of promotions and bonuses for players, including a welcome bonus for new players, and a loyalty program for regular players.

Overall, Bet365’s poker room is a solid option for players looking for a wide variety of games, tournaments and features. The platform’s user-friendly interface, responsive customer support and various bonuses make it a great choice for both casual and serious poker players.

Bet365 Customer Support

Bet365 offers a comprehensive customer support system to ensure that its customers have a smooth and enjoyable experience. The customer support team is available 24/7 to answer any questions or concerns that you may have.

There are several ways to contact customer support, including live chat, phone, and email. The live chat feature allows you to have a real-time conversation with a customer support representative, making it the quickest way to get help. Phone support is also available, and you can speak with a representative directly. Email support is another option, and you can expect a reply within a reasonable time frame.

Bet365 also has an extensive FAQ section on its website, where you can find answers to the most common questions. The FAQ section is divided into different categories, such as account, deposits, and withdrawals, making it easy to find the information you need.

Overall, Bet365’s customer support team is dedicated to providing the best possible service to its customers and will work to ensure that all of your issues are resolved in a timely and efficient manner.

FAQ

Conclusions

What are some of the key takeaways from a Bet365 review?

Bet365 is one of the world’s leading online gambling companies, offering a wide range of services including sports betting, casino, poker, and bingo. It is known for its user-friendly platform, extensive selection of markets and events, live streaming options, and cash out feature. Bet365 also prioritizes responsible gambling and offers tools such as deposit limits and self-exclusion. Its mobile app is also highly rated for its functionality and usability. Bet365’s customer support is available 24/7 through various channels, and typically receives positive reviews for its response times and helpfulness. Overall, Bet365 is a reputable and well-rounded option for online gambling. Some of the cons of the platform are that it may not be available in certain countries, and that some users have reported issues with account verification and withdrawal processes. Additionally, Bet365’s promotions and bonuses for existing customers are not as generous as some of its competitors.

In conclusion, Bet365 is a well-established and reputable online sportsbook and casino. The company offers a wide range of services including sports betting, casino games, poker and bingo. The customer support team is available 24/7 and offers multiple channels of communication. The poker room offers a variety of tournament schedules and cash game options. The casino features a diverse selection of slots, table games, and live dealer options. Depositing money into your account is easy and can be done through a variety of methods, including e-wallets, credit/debit cards, and bank transfers. Bet365 offers promotions and bonuses for both new and existing customers. The mobile app is convenient and user-friendly, with features such as live streaming, in-play betting, cash out, and Bet Builder. The company’s sportsbook history is extensive and has solidified its position as one of the world’s largest online gambling companies. The odds offered by Bet365 are competitive compared to other popular online sports betting platforms. Overall, Bet365 is a great option for those looking for a reliable and enjoyable online gambling experience.